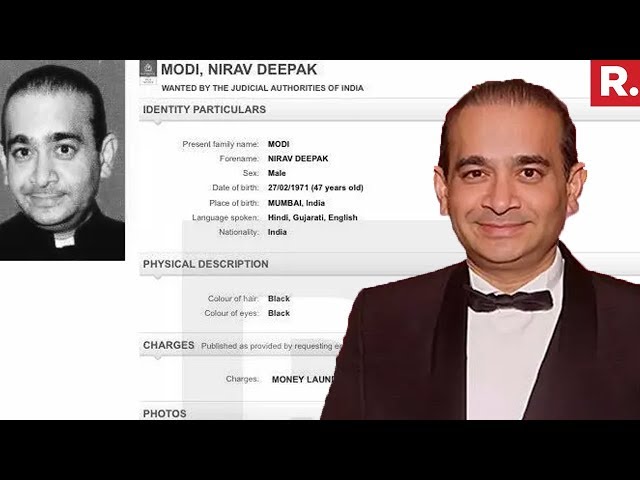

Interpol has issued a Red Corner Notice (RCN) against fugitive diamond jeweller Nirav Modi, the main accused in the Rs 13,600-crore Punjab National Bank (PNB) scam, news agency ANI reported. Earlier, the Enforcement Directorate (ED) had requested Interpol to issue a RCN against the billionaire jeweller. The ED had also filed an application in the court seeking permission to start extradition of the absconding diamantaire in connection with the PNB fraud.

Red Corner Notice issued against Nirav Modi by Interpol in connection with #PNBScamCase pic.twitter.com/pOeE09SCUy

— ANI (@ANI) July 2, 2018

It may be noted a RCN asks Interpol member nations to arrest and extradite Nirav Modi, who left India in the first week of January, weeks before the state-run bank filed a complaint with the Central Bureau of investigation (CBI). According to the ED, Nirav Modi is in the UK and needs to be extradited as non-bailable warrant (NBW) has already been issued against him, and he is not appearing before the court even after prosecution complaint.

In the charge sheet, the ED had mentioned the modus operandi used by Nirav Modi and his family to successfully launder money. Nirav Modi had himself hired directors in his company and even routed money through a number of dummy companies. According to the officials, the 12,000-page ED chargesheet, or the prosecution complaint, was filed before a special Mumbai court under various sections of the Prevention of Money Laundering Act 2002 (PMLA).

The Ministry of External Affairs (MEA) last week sought help from a select group of European countries to trace and confine Nirav Modi's movements. Last month, the country’s premier investigative agency had said that the disgraced business tycoon travelled across several countries, even after the Indian government's notification about his passport being revoked was available on Interpol’s central database.

For those unversed, the state-controlled PNB detected the multi-crore scam this year, wherein Nirav and his uncle-cum-business-partner Mehul Choksi had allegedly cheated the bank to the tune of about Rs 13,600 crore, with the purported involvement of a few employees of the bank

.jpeg)