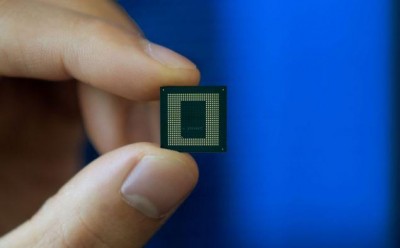

New Delhi, Amid the global chip shortage that is going to worsen with the Russia-Ukraine war, a new report has shown that the global smartphone AP (Application Processor)/SoC (System on Chip) chipset shipments grew 5 per cent (on-year) in the fourth quarter of 2021.

5G smartphone SoC shipments were almost half of the total SoC shipments, according to Counterpoint Research.

MediaTek led the smartphone SoC market with a share of 33 per cent in Q4.

"MediaTek's smartphone SoC volumes declined due to the high shipments in the first half and inventory corrections from Chinese smartphone OEMs. Many customers had built chipset inventories to manage uncertainties in the supply situation," informed research director Dale Gai.

Qualcomm recorded a very strong quarter, growing 18 per cent (on-quarter) and 33 per cent (on-year) despite component shortages and foundry capacity not being able to keep up with demand.

"Qualcomm was able to prioritise high-end Snapdragon sales, which come with higher profitability and less impact from shortages than mid-end and low-end mobile handsets," said senior analyst Parv Sharma.

Qualcomm captured a 76 per cent share in the 5G baseband shipments, driven by Apple's iPhone 13 and 12 series and premium Android portfolio.

"Qualcomm's Snapdragon 8 Gen 1 flagship mobile platform will start shipping from this quarter.

"The performance in Q1 2022 will be driven by design wins in the Samsung Galaxy S22 series and launches in the Chinese New Year. Overall, the next inflection in growth will be in H2 2022 with the launch of 5G handsets by major OEMs," Sharma noted.

Apple maintained its third position in the smartphone SoC market in Q4 2021 with a 21 per cent share. The iPhone 13 launch and festive season drove the shipments.

Samsung Exynos slipped to the fifth position with a 4 per cent share as Samsung is in the middle of rejigging its smartphone portfolio strategy of in-sourcing as well as outsourcing to Chinese ODMs (original design manufacturers).

.jpeg)