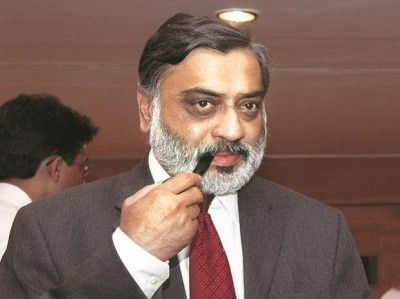

Mumbai, A India Inc. on Thursday mourned the passing of Ravi Parthasarathy, considered the trailblazer of the PPP model and the former CEO and Chairman of the 35-year-old failed Infrastructure Leasing & Financial Services (IL&FS), who succumbed to a four-year-old battle with cancer.

Several players from the corporate world, including his colleagues and acquaintances, took to social media to pay homage to their favourite 'RP', as he was known, and a few also took sharp potshots at the departed soul.

Parthasarathy, 70, is best known for his long tenure at the IL&FS, joining as President and CEO in 1987, and elevated as Managing Director in 1989 and then as Chairman in 2006 of the non-banking financial institution promoted by Central Bank of India along with UTI and HDFC.

An IIM-A alumnus, RP helmed the IL&FS affairs till he voluntarily quit as Chairman in 2018 citing health reasons, after which the company which he had built and nurtured for 30 years, suddenly erupted into a mega-financial mess.

Under RP, the IL&FS jumped from a small consultancy firm into an infrastructure finance group, with 346 subsidiaries, big development projects worth thousands of crores of rupees under its belt, and quietly also piled up a dead-weight of Rs 99,000-crore as overall debts, loan defaults or failed commitments.

Following this he and other Il&FS bigwigs came under the scanner of the various probe agencies and RP was arrested by the Enforcement Directorate in 2021 and even the Chennai Police for allegedly cheating depositors.

After his demise, several recalled and lauded his efforts that made IL&FS into an unique entity promoting Public-Private-Partnerships, and functioning as a the bridge between the two, that helped execute several key infrastructure projects across all sectors in the country.

After its shocking collapse by end-2018 due to inability to repay loans to several Indian banks, insurance companies and others, the government initiated a resolution process, which has been partly completed.

.jpeg)