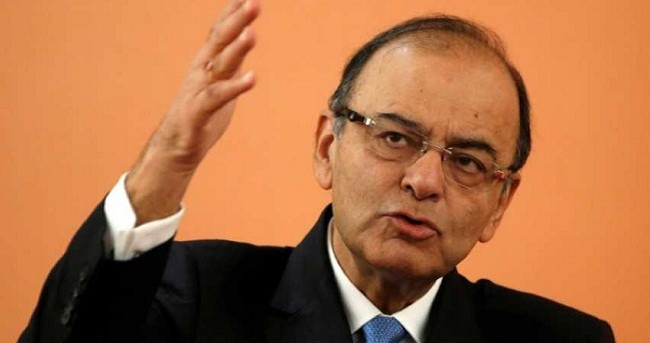

Finance Minister Arun Jaitley Tuesday said the government never sought the resignation of Urjit Patel as Governor of the Reserve Bank of India over differences in handling liquidity stress in certain sectors.

Speaking at an eventk, he said the government does not need a single penny from RBI's capital reserves during the current fiscal.

Responding to criticism over surprise resignation of Patel as RBI Governor earlier this month, he said there were cordial discussions at the meeting of the RBI board over issues such as the appropriate size of reserves the central bank must hold.

"The government never asked for his resignation," he said.

After Patel's resignation, the government appointed former bureaucrat Shaktikanta Das as the Governor of RBI.

Reserve Bank of India (RBI) governor Urjit Patel resigned earlier this month, citing personal reasons.

"On account of personal reasons, I have decided to step down from my current position effective immediately," Patel said in a brief statement put up on the central bank's website.

He added that it has been his privilege and honour to serve in the RBI in various capacities over the years. "The support and hard work of RBI staff, officers and management has been the proximate driver of the bank's considerable accomplishments in recent years. I take this opportunity to express gratitude to my colleagues and directors of the RBI central board, and wish them all the best for the future."

The resignation, sources say, was the outcome of the weeks-long friction between the central bank and the government over the access to RBI's contingency reserves of Rs 9.2 lakh crore and relaxed guidelines for tackling non-performing assets in the Indian banking system.

Many believe that the RBI board meeting of October 23 was the turning point. The 9-hour-long meeting ended inconclusively for the first time and the second round of the meeting was called on November 19. This seemed to have ended on a conciliatory note with both sides meeting half-way with some give and take.

Some RBI officials told DNA Money that the induction of some independent directors was blurring the line between the RBI and the government.

.jpeg)